[ad_1]

Looking like it is going to remain a “buy on the dip” market

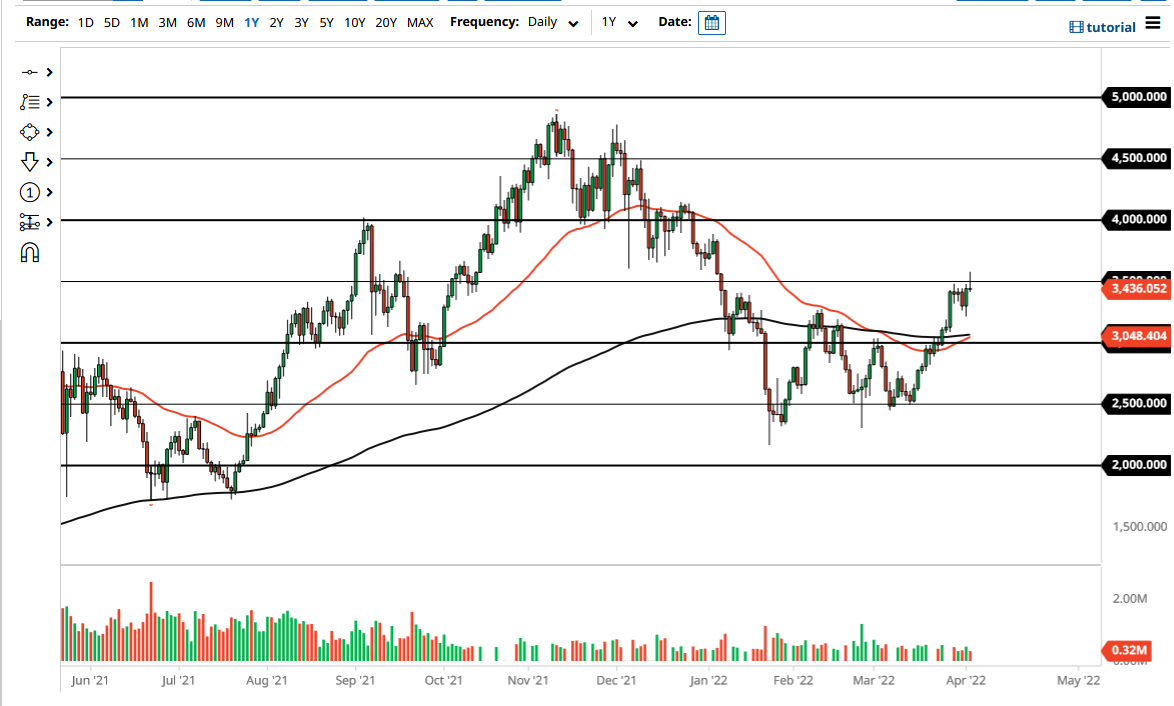

Ethereum markets spiked higher during the trading session on Monday to break above the $3500 level. However, we have given back those gains to show signs of hesitation and exhaustion, forming a shooting star. The shooting star is a very negative candlestick and does show that there is quite a bit of pressure in the $3500 level.

Furthermore, the 50 Day EMA is starting to turn higher, perhaps getting ready to break above the 200 Day EMA. This would be a “golden cross”, something that longer-term traders pay close attention to as a “buy-and-hold” sign. The market has recently broken out of a massive “W pattern”, which is also bullish. In other words, most of this chart looks bullish with the exception of the candlestick and the $3500 level that has proven to be important over the last 24 hours.

More likely than not, any pullback at this point will probably be an attempt to find support underneath to build up the necessary momentum to continue the uptrend. However, we have rallied so significantly that it would not be surprising at all to see this pullback before we can truly take off to the upside. I believe that the market is still bullish as long as we can stay above the $3200 level, perhaps even the $3000 level.

Alternately, if we were to break above the top of the candlestick for the trading session on Monday, then it could open up the possibility of a move to the $3750 level, perhaps even the $4000 level. The “W pattern” has a “measured move” that suggests that we should go to the $4500 level eventually, but the keyword here is going to be “eventually.” After all, the market does tend to be very noisy, but we are starting to see more positivity involving the merge in the Ethereum blockchain, so therefore it is likely that we would see more demand as time goes forward. However, we also have to worry about the risk appetite and profile of traders out there, because there are a lot of things out there that could cause headaches for higher-risk assets such as Ethereum, which has absolutely nothing to do with Ethereum itself.This looks as if it is going to remain a “buy on the dip” market.

[ad_2]