[ad_1]

Investors balance the economic performance and the future of monetary policy tightening by central banks which is still in favor of more strength in the price of the US dollar against the Japanese yen currency pair USD/JPY. The currency pair started trading this week to reach the threshold of resistance 123.00 as the performance was at the end of last week’s trading. The US jobs report was supportive of the expectations of raising US interest rates, which supported the US dollar.

According to official figures, the United States of America added nearly half a million jobs in March and the country’s unemployment rate fell more than expected, highlighting a strong labor market that is likely to support strong Fed tightening in the coming months. Friday’s Labor Department report showed that US non-farm payrolls increased by 431,000 last month after an upwardly revised 750,000 in February. The country’s unemployment rate has fallen to 3.6 percent, near its lowest level before the pandemic, and the labor force participation rate has soared.

Expectations were for a total of 490,000 jobs to be added and the unemployment rate to drop to 3.7 percent. Accordingly, short-term Treasury yields rose, and the US dollar strengthened after the release on expectations that the data would support the Fed’s hawkish policy.

The data suggests that the US labor market recovery continues at a robust pace as employers are better off filling a near-record number of jobs. Inflation, diminishing excess household savings and robust wage growth are factors that could attract more Americans to jobs in the coming months. COVID has also become a less important factor as countries have broadly lifted restrictions.

For their part, Fed officials, including Chairman Jerome Powell, have said in recent weeks that they will support more aggressive monetary policy to rein in decades-old high inflation, including a possible 50 basis point increase at the next policy meeting in May. Central bankers have repeatedly cited the strength of the labor market as one of the reasons the US economy has been able to handle a series of interest rate hikes that are expected to extend into next year.

Friday’s report showed average hourly earnings rose 0.4 percent from February and 5.6 percent from a year ago, the most since May 2020. However, inflation – at its highest levels since the early 1980s – It outpaces wage growth, and effectively deals with salary. It reduced to many Americans and began to weaken consumer demand. Despite the strength of the labor market, US President Joe Biden’s acceptance ratings from Americans have been affected by rising inflation. Biden announced Thursday that the United States will release 1 million barrels of oil per day from reserves for six months to help mitigate rising gasoline prices.

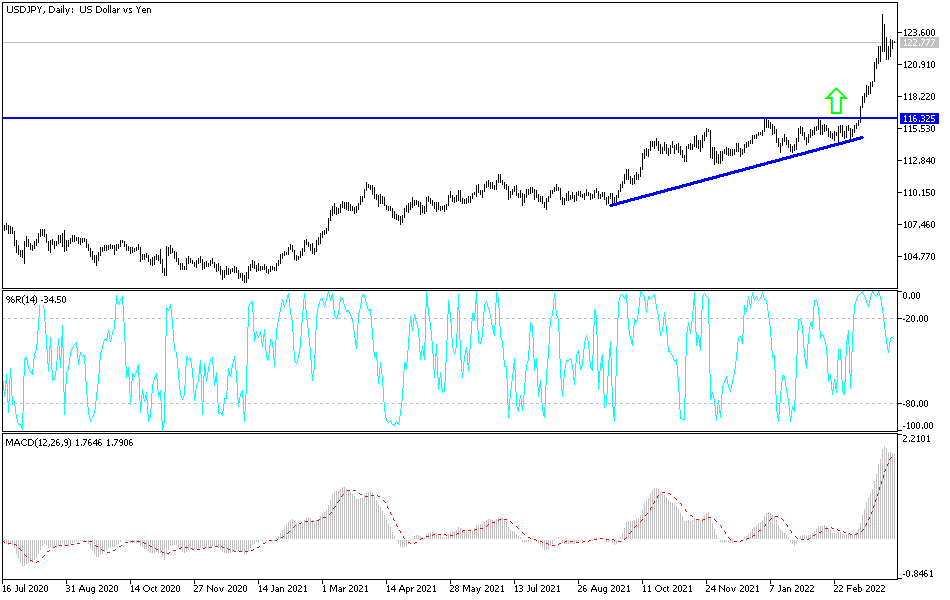

According to the technical analysis of the pair: On the daily chart, the price of the USD/JPY currency pair is still moving amid bullish momentum, waiting for anything new. The current stability around the resistance level 123.00 will support the bulls’ dominance for more directional strength, and therefore move towards stronger ascending levels, the closest to them currently are 123.60, 124.20 and 125.00, respectively. Despite this, the currency pair may be exposed to profit-taking operations because these levels are sufficient to push the technical indicators towards overbought levels, which we support selling from every bullish level.

On the other hand, and over the same time period, it will be important to break the 120.00 and 118.50 support levels to abandon the current bullish outlook.

[ad_2]