[ad_1]

In general, this is a market that I think will continue to see volatility more than anything else, just like the rest of crypto.

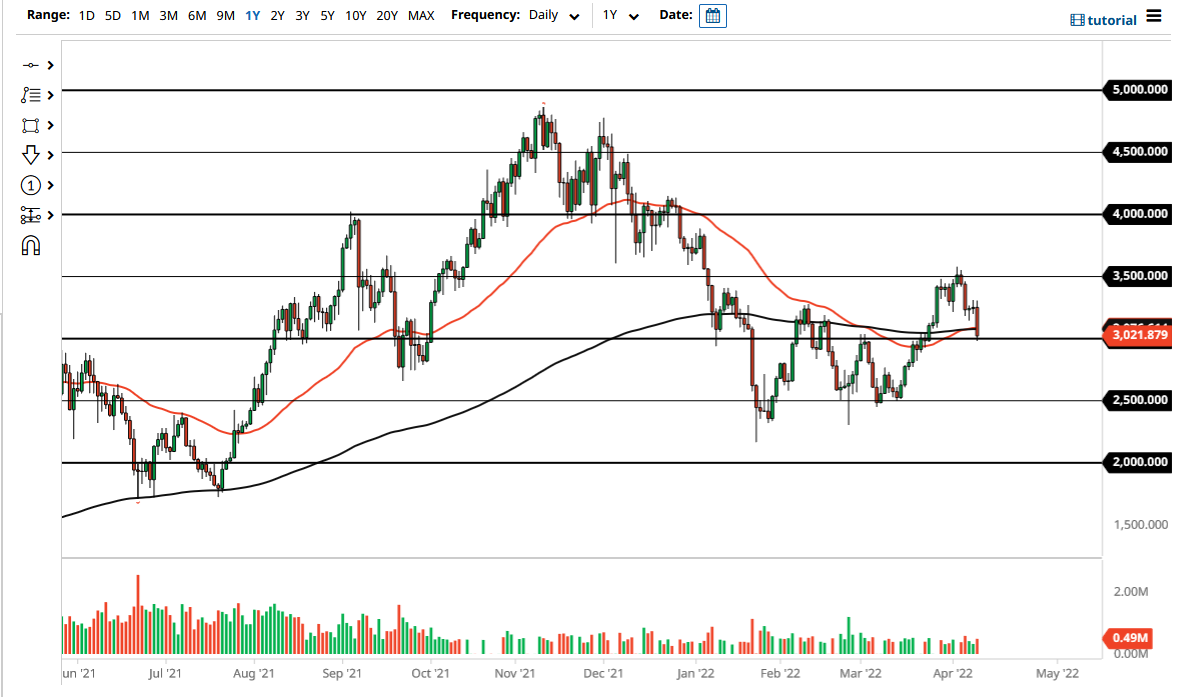

Ethereum fell rather significantly on Monday, initially trying to rally before selling off. The market sliced through the 50-day EMA, as well as the 200-day EMA. The $3000 level is a large, round, psychologically significant figure, which will attract a certain amount of attention. We have bounced ever so slightly from there, but closed toward the bottom of the candlestick, suggesting that we could get a little bit of a continuation from here.

Breaking below the $3000 level could open up a move to much lower levels, possibly even as low as the $2500 level. The $2500 level has been massive support multiple times, so I would think this is an area that a lot of people will be looking to get involved in. That is an area that I think will be crucial for the longer-term strength of Ethereum, and as long as we can stay in that area. That being said, if we were to break down below the $2500 level with any type of significance, the market could go looking to reach the $2000 level.

The size of the candlestick is rather negative as well, as it is much bigger than a previous couple of candlesticks. If we were to turn around and take out the top of the candlestick, it is very possible that the market would go looking to reach the $3500 level. The $3500 level has seen a significant amount of selling pressure, so I think it would take a bit of momentum to send this market above there. If we break above there, then it is possible that we could go to the $4000 level. The $4000 level is an area that has been nasty, so I think it is going to take a lot to get above there.

Ethereum is in the midst of going through a major transformation, and if the switch to “Ethereum 2.0” goes off well, that should help the price of the coin. As more developers jump online, that can only help. However, this is a market that currently looks as if it is ready to break down a bit, at least for the short term. In general, this is a market that I think will continue to see volatility more than anything else, just like the rest of crypto.

[ad_2]