[ad_1]

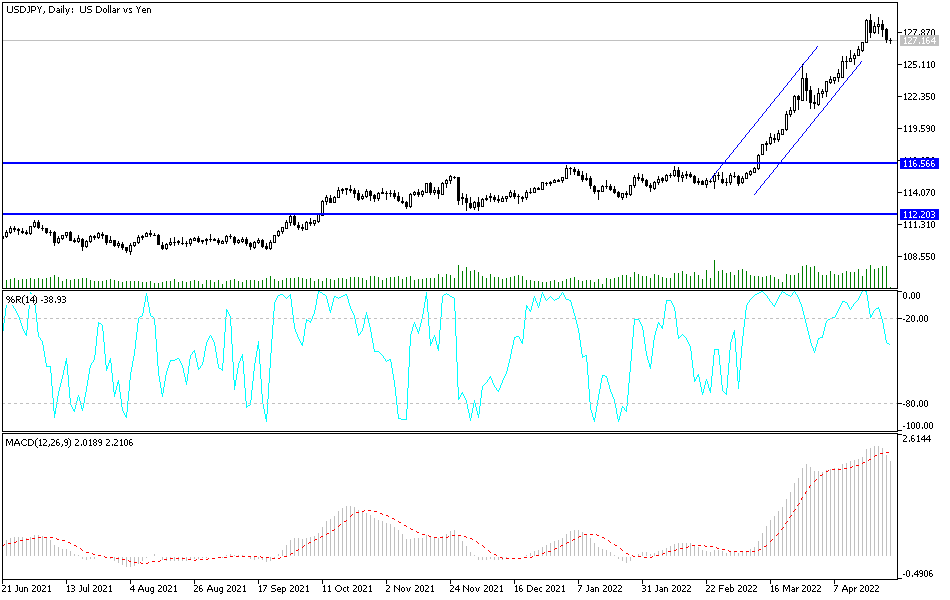

Despite three consecutive trading sessions, during which the price of the USD/JPY was subjected to sell-offs, it moved towards the support level 126.92 and settled around 127.20 at the time of writing the analysis. The selling came after the currency pair gained towards the 129.40 resistance level, the highest for the currency pair in 20 years. The recent performance so far, the USD/JPY pair has not come out of its upward trend, which is still supported by strong expectations for the future of raising US interest rates during the year 2022 to face the fiercest global inflation waves caused by the epidemic and recently the Russian / Ukrainian war.

The yen is a popular asset during turbulent times.

Despite expectations of a US interest rate hike. US 10-year Treasury yields are close to 3% — a level not seen since late 2018. But short-term yields are rising faster with the two-year US yield gaining 33 basis points over the past week compared to the 10-year increase of 18 basis points. And all of this because market rates are raised by 50 basis points by the Federal Reserve at every meeting in 2022.

These moves have flattened the 2-year 10-year bond curve in the US, with the result that our recession model once again sets a 50% chance of a recession in the next 12 months. Accordingly, it seems that the stocks have noticed a noticeable weakness.

Meanwhile, the Fed’s recession model, which uses the 3m10y portion of the yield curve, continues to give only a 2% probability of a recession. Macro Hive has presented two models for predicting a US recession using the slope of the yield curve. When the long-term returns begin to fall towards or below the short-term returns, the curve flattens or reverses.

This often predicted a recession in subsequent months.

One of the models from the Fed is based on the 3m 10h curve and the second is our modified version based on the 2x10h curve. The two years could better reflect expectations for Fed increases in the coming years.

On the economic side: US consumer confidence slipped slightly in April but remains elevated even as inflation continues to cloud their optimism for the rest of the year. Accordingly, the Conference Board said yesterday that the US Consumer Confidence Index – which takes into account consumers’ assessment of current conditions and their expectations for the future – fell to 107.3 in April, from 107.6 in March. The Business Research Group’s Current Situation Index, which measures consumers’ assessment of current business and business conditions, also fell modestly this month to 152.6 from 153.8 in March.

The expectations index, which is based on consumers’ six-month expectations for income, business and the labor market, rose to a reading of 77.2 in April from a reading of 76.7 in March. It settled at 80.8 in February and remains a weak spot in the survey. Commenting on the performance, Lynn Franco, senior director of economic indicators at the Conference Board, said: “Buy intentions have generally fallen from recent levels as interest rates started to rise.” Meanwhile, concerns about inflation eased from an all-time high in March but remained elevated.

Franco added that inflation and the war in Ukraine will continue to erode confidence and may further reduce consumer spending this year.

Despite the recent sell-offs, the general trend of the USD/JPY currency pair is still bullish, and there will be no break out of the descending channel below without the currency pair moving towards the support levels 125.00 and 122.20. On the other hand, the resistance 128.20 will remain important to reach the psychological peak 130.00.

The discrepancy in the economic performance and the future of raising interest rates from global central banks will remain factors that support the upward trend of the currency pair.

Today, the USD/JPY pair will be affected by risk sentiment.

[ad_2]