[ad_1]

We expect the lira to continue to decline, especially if the pair closed the highest levels of psychological resistance at 15.00.

Today’s recommendation on the lira against the dollar

Risk 0.50%.

The sell trade of the recommendation was activated on Thursday and a profit was exited with you resting the stop loss point and closing half the contracts with the price moving towards the target

Best entry points buy

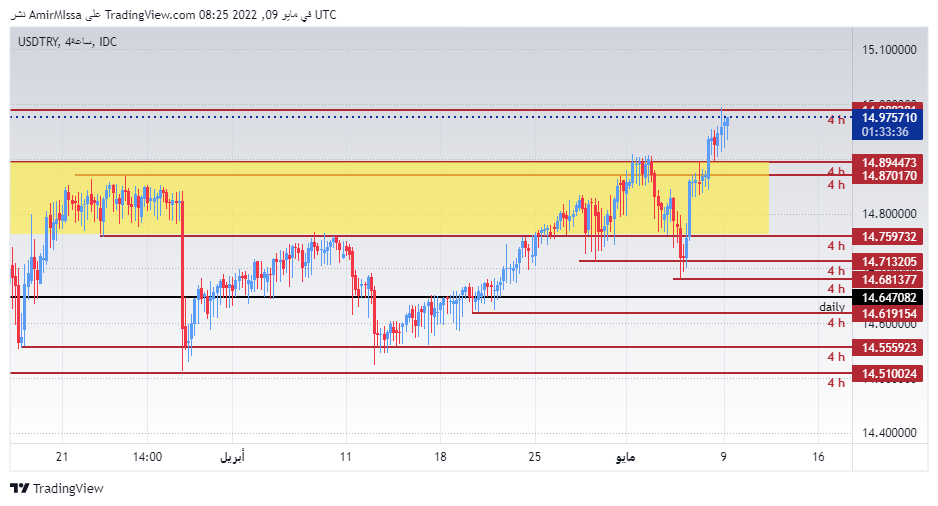

- Entering a long position with a pending order from 14.68 . levels

- Set a stop-loss point to close the lowest support level 14.46.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 14.85.

Best selling entry points

- Entering a short position with a pending order from 14.99 . levels

- The best points for placing a stop loss are closing the highest levels of 15.08.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.40

The Turkish lira continues to decline against the US dollar, which is witnessing great demand from investors in light of the expectations of the continuation of the monetary tightening policy by the US Federal Reserve. The lira is experiencing a special kind of pressure with Turkish President Recep Tayyip Erdogan’s insistence on reducing the interest rate, contrary to what central banks around the world have followed. This raised the interest rate in the wake of the Fed’s decision to raise the interest rate by 50 basis points. At the present time, amid the economic decline in the country, the Turkish Central Bank could not keep pace with Erdogan’s desire to reduce the interest rate, as it was satisfied with fixing it since the beginning of the year. This contrasts with a series of cuts he followed over the past year, which pressured the lira to lose about half of its value. Reports of high inflation also contributed to the pressure on the lira. Data appeared at the end of last week showing a rise in the inflation rate in the country to 70 percent, which is record levels that have not been recorded for decades.

On the technical front, the Turkish lira fell slightly against the dollar during today’s trading, as the Turkish currency continued to decline. However, the Turkish lira is still trading within a limited trading range. It is noticed that the pair exceeded the demand areas shown on the chart. The pair also rose above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame. The pair is trading the highest support levels, which are concentrated at 14.90 and 14.87 levels, respectively. On the other hand, the lira is trading below the resistance levels at 15.00 and 15.10. We expect the lira to continue to decline, especially if the pair closed the highest levels of psychological resistance at 15.00. Please adhere to the numbers in the recommendation with the need to maintain capital management.

[ad_2]