[ad_1]

I think the sellers will continue to come back into this market to take advantage of any attempts at recovery.

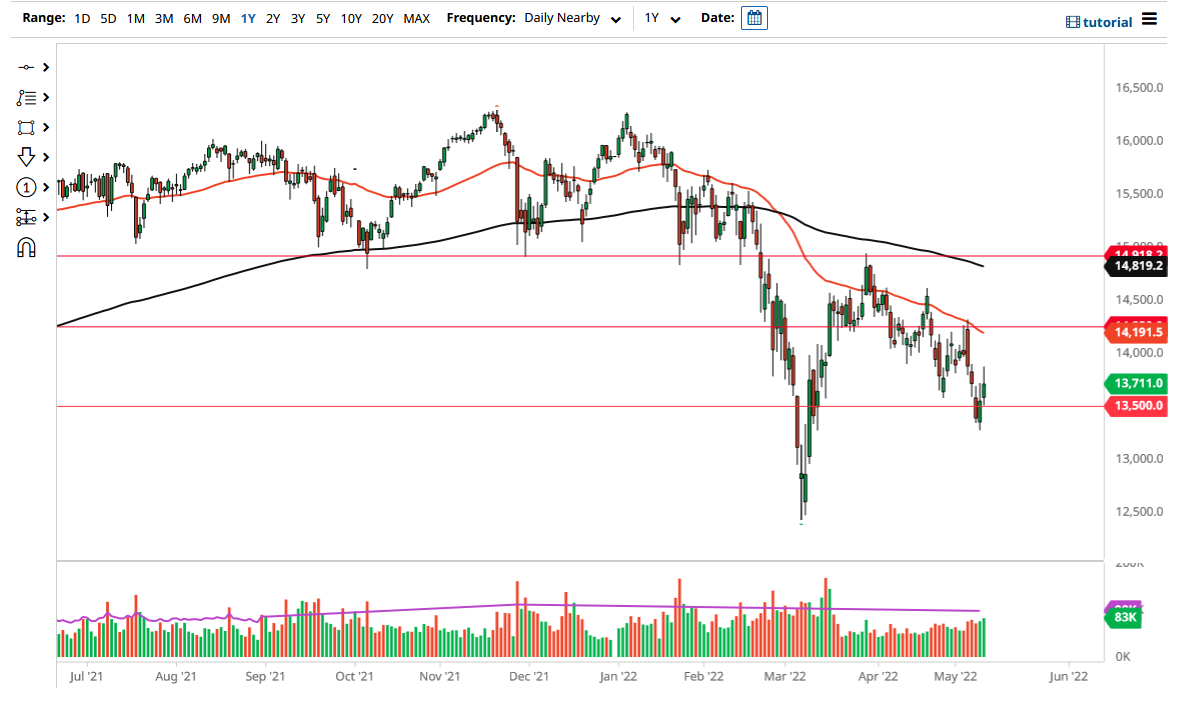

The German DAX Index rallied significantly on Wednesday in the futures market to reach the €13,888 level. By doing so, the market ran into a bit of resistance, as we pulled back just a bit. That being said, the market looks as if it is forming a bit of a shooting star, and I think it does make quite a bit of sense that we continue the downward momentum. I have no interest in buying this market because there are a lot of concerns out there when it comes to the global equity markets.

Current volatility is making great stock trading opportunities – don’t miss out!

Of particular note will be the European Union, as there are a lot of very negative economic numbers that people have to worry about, so it is going to be interesting to see whether or not money will flow back into Germany. It is the first place that people put money to work, but at the end of the day, it is European so there is no real way to get away from all of this danger. The DAX depends on the rest of the world as well, as there are so many exporters that there is a huge portion of this market.

The euro is relatively cheap, so that is the one thing that helps the DAX, but at this point it looks like most of the world is very vulnerable to the idea of a recession, and that means less spending. Less spending means less demand for those German goods. The €13,500 level in the futures market is short-term support, and if we break down below there, we could go looking to reach down to the €13,250 level, where we had bounced from just a couple of days ago.

Regardless, we are most certainly in a downtrend and that has not changed. I think the sellers will continue to come back into this market to take advantage of any attempts at recovery. The €12,500 level underneath will be supported, as it was where we had bounced from previously. That might be our target, but I think it could take a little while to get down there. Keep in mind that markets do not go in one direction forever, so a short-term bullish relief rally could occur at any point, but at that juncture you need to be thinking about when you can start shorting again.

[ad_2]