[ad_1]

We have been in a downtrend for quite some time so it makes sense that we would see a continuation.

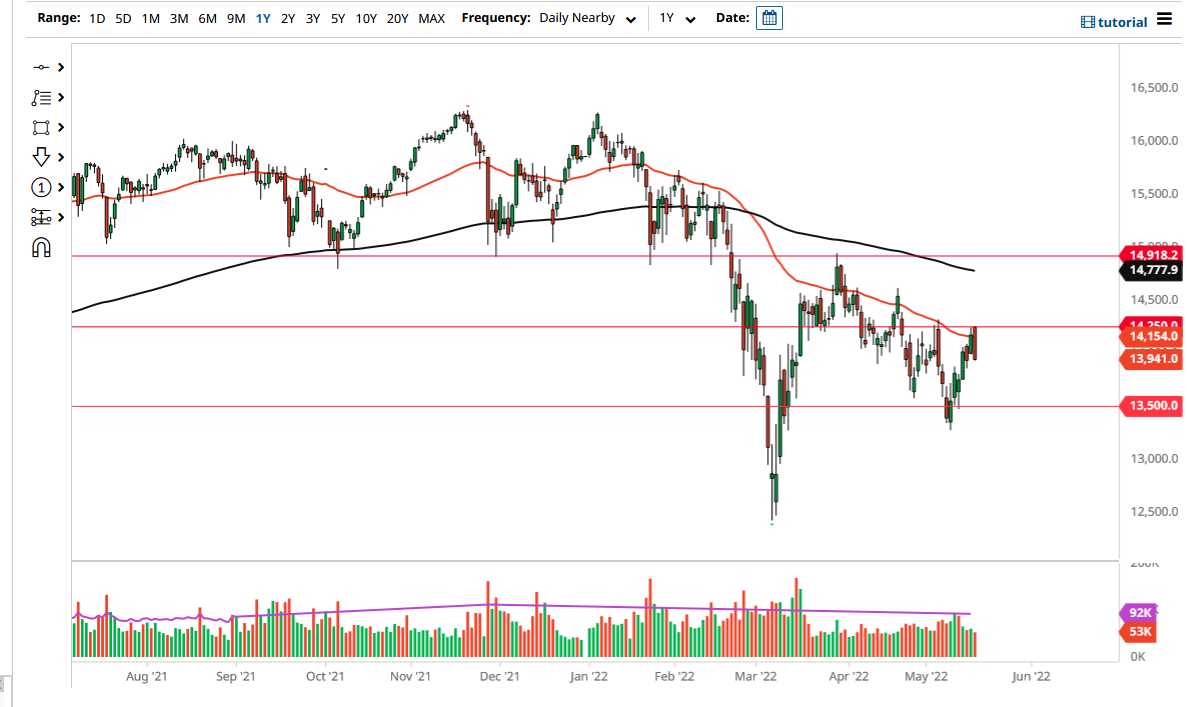

The German DAX index broke down significantly on Wednesday as the €14,250 level continues to offer significant resistance. This is an area where we have seen selling pressure previously, so it is not a huge surprise to see that we had pulled back. Furthermore, the 50-day EMA has been resistant as well, so it all ties together quite nicely.

What is also worth noticing is that we close at the bottom of the candlestick, and it suggests that we are going to see even more selling pressure. Typically, when a candlestick closes at the very bottom of the daily range, there is a bit of follow-through. At this point, I am looking for a move down to the €13,500 level over the next several candlesticks, and I believe that short-term rallies will probably be sold into at the first signs of exhaustion. The DAX is the main index for the European Union, so you need to understand that it is a great proxy for the entire region. It is the first place that money goes flying to, and it tends to lead the rest of the indices either higher or lower.

That being said, if the situation gets worse in the European Union, other indices will get sold rather hard. On the other hand, if we start to see a bit of a turnaround, the DAX is the first place that people put money to so it is also the first place that people start to see a rally. At this point, it is likely that we will continue to see the global economic situation have a part to play as well, as Germany is such a major exporter. In fact, most of the major movers of the DAX index are multinational exporters, so they cannot escape what we may find in other parts of the world.

Regardless, we have been in a downtrend for quite some time so it makes sense that we would see a continuation. Indices around the world have been hammered, and for what it is worth, American indices sold into the close, so that typically means that the Europeans will take their cue from that as well. I do not see a turnaround happening, but if we broke above the €14,250 level, we would more likely than not be a very bullish move.

[ad_2]