[ad_1]

It has been a nice pace of an uptrend, meaning that we are not overdone, and we could continue to see a “steady as it goes” type of situation.

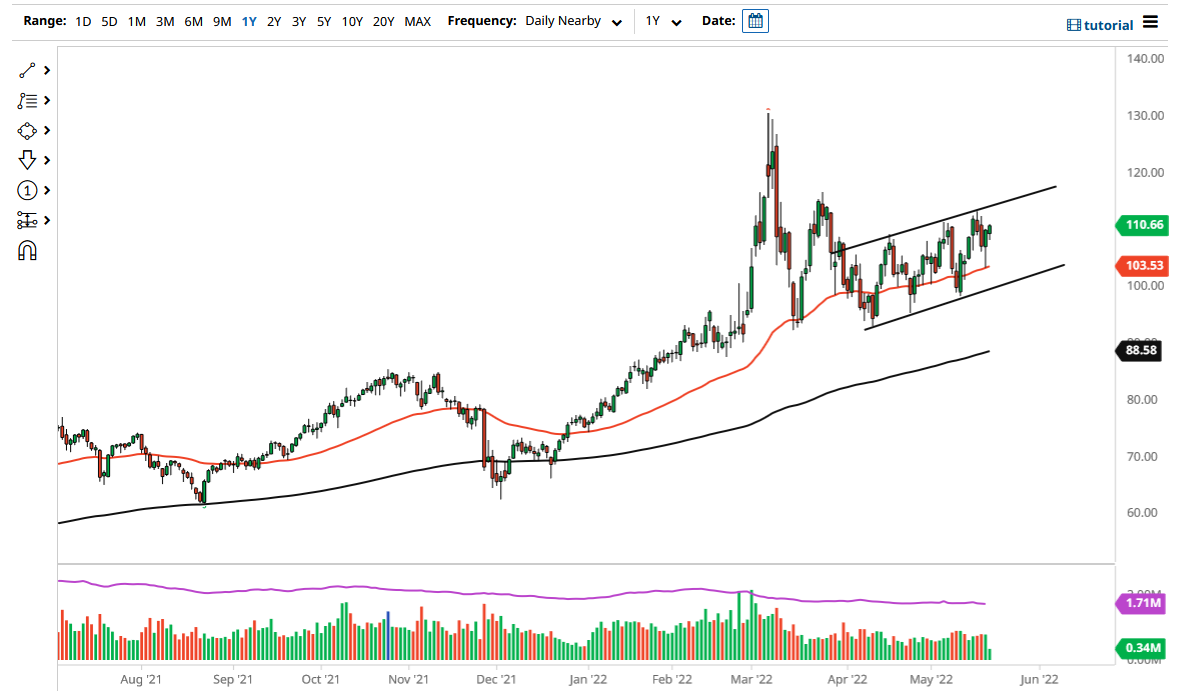

The West Texas Intermediate Crude Oil market initially pulled back a bit on Friday but then found buyers again to break above the $110 level. That being said, the market is likely to continue seeing quite a bit of noisy behavior, and of course upward pressure. The 50-day EMA sits underneath and is offering dynamic support.

The 50-day EMA also extends support down to the previous uptrend line, as we are in a huge uptrending channel, and I think that will continue to be the case. Ultimately, if we can break above the $115 level, then the WTI market is likely to continue going higher, perhaps reaching the $120 level. Breaking above the $120 level allows the market to go looking to the $130 level. In general, this is a situation where even though the US dollar continues to strengthen, there is enough inflation out there to continue driving the price of crude oil higher.

If we were to break down below the $100 level, then it is possible that we could see the market break significantly lower, perhaps reaching down to the $90 level. At that point, then we would have to pay close attention to the 200-day EMA, which is a major technical indicator that a lot of people would pay attention to. At that point, we may see a little bit of a bounce.

That being said, I think that it is more likely than not that we break to the upside. It is especially encouraging that we rallied into the weekend, meaning that people are more than willing to hang on to the contract heading into the weekend and that shows conviction. Any time we pull back I think there will be plenty of people willing to pick it up. We are in this nice channel, and it is likely that we will continue to see the market respect this area, but you also have to be cognizant of the fact that if we break out of that channel, then you have to pay attention because it would mean something is changing in the market. It has been a nice pace of an uptrend, meaning that we are not overdone, and we could continue to see a “steady as it goes” type of situation.

[ad_2]