[ad_1]

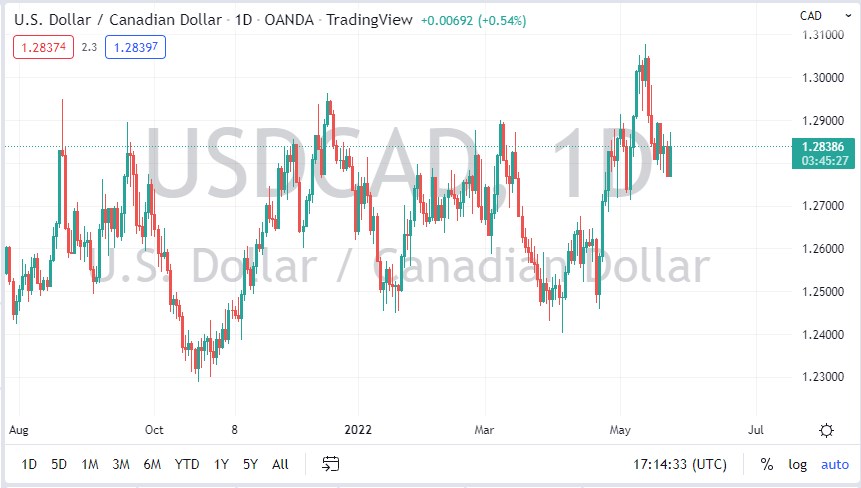

In general, this is a market that I think continues to see a lot of volatility, but it does certainly look as if it still favors the upside.

The US dollar bounced a bit on Tuesday ends the 50-day EMA has brought in some fresh buying. The market bouncing from that level, and the 1.28 level for that matter, does suggest that we are still trying to pick up our feet. The US dollar has been trying to build up a bit of a base over the last couple of days, and now it looks like we are trying to perhaps even build up enough momentum to take off to the upside.

If we can break above the 1.29 level, then it’s likely that we will test the 1.30 level above, which is where we have pulled back from. That area is of course going to be resistance, and at this point, I think it does make for a nice short-term target if we continue to see strength. On the other side of the equation, you should also pay attention to the crude oil market, because it does tend to help the Canadian dollar. However, both the US dollar and the crude oil markets can rally at the same time.

It’s worth noting that the market has been grinding higher over the last couple of months, and we have pulled back to roughly 50% of the initial move. If we can break above the highs from a couple of weeks ago, then it’s likely that the US dollar could go reaching C$1.33 or more. Short-term pullbacks offer value that a lot of people will be interested in, and I think it continues to be a “buy the dip” type of setup. If we break down below the 50-day EMA, then the market could go looking to reach the 1.27 level, but we also have the 200-day EMA as well.

I don’t really have a situation where willing to sell this market anytime soon, because if I were to trade the Canadian dollar based on the oil market, then I would get long CAD/JPY. In general, this is a market that I think continues to see a lot of volatility, but it does certainly look as if it still favors the upside. The interest rate differential and of course “risk-off attitude” could help the greenback against most currencies, including the Canadian dollar as we have seen.

[ad_2]