[ad_1]

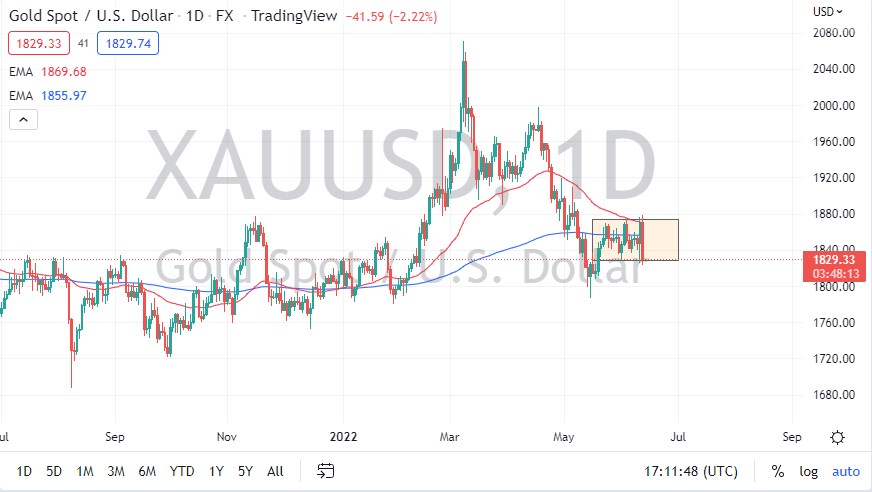

Gold markets tried to go higher at the open on Monday but have found so many sellers out there that they have collapsed and slammed into the bottom of the overall range that we have been in for some time.

This is because the 10-year yield in the United States broke above the 3.25%, and then went all the way to the 3.35% level. As long as yields continue to rally the way they have, gold will not be attractive, and therefore it’s a situation where you are going to see almost anything priced in US dollars face downward pressure.

The size of the candlestick is huge, and that suggests that we are going to continue to see a lot of negative pressure, and as long as that’s going to be the case, I just don’t see that buying gold will be doable. In fact, it’s not until we break above the $1880 level that I am going to consider trading gold; however, I must admit that I am more of a swing trader and less of a range-bound trader. If you are a range-bound trader, it might be worth trying to bet on a bounce, but you would have to keep a very close on the 10-year note.

If we break down from here, then it’s likely that we go down to the $1800 level, which is a large, round, psychologically significant figure, and an area that should be a massive support. However, if we turn around and break to the upside, it opens up the possibility of $1900, maybe $2000 after that. Ultimately, this is a market that is probably stuck, but it’s going to take all of its cues from the Federal Reserve.

At this point, the Federal Reserve is going to break something, but I don’t think it’s necessarily going to be the gold market. Yes, gold could fall apart from here, but unlike most other assets, gold has 5000 years of backing and as far as being worth something. Granted, if you are levered, that’s not going to do any good, but at this point, I think we got a scenario where the market should give you a nice buying opportunity eventually, but it might be at a lower level based on what I’m seeing in the greenback and of course the bond markets.

[ad_2]