[ad_1]

I’m looking for signs of exhaustion that I can sell into, perhaps off the daily chart.

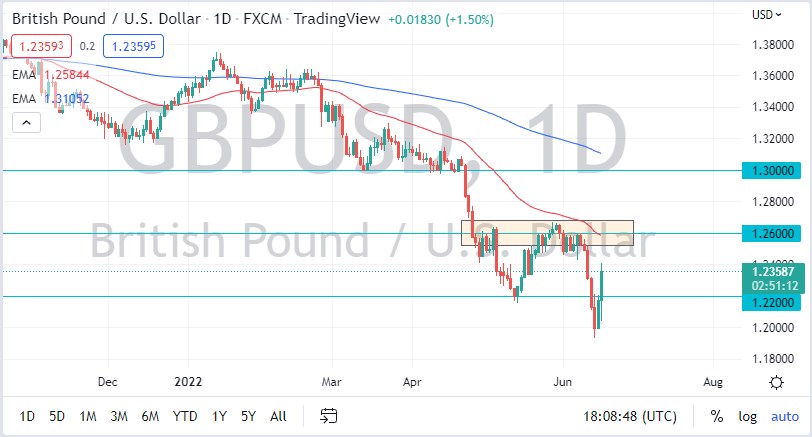

The British pound initially fell on Thursday but then turned around to break above the 1.22 handle. In fact, by the end of the day, we reached the 1.24 level, exacerbated by the noise around the Bank of England interest rate decision and press conference. At this point, it looks to me like the British pound had been oversold anyway, so a relief rally was probably always coming. I do not look at this as the likelihood of the market changing direction, just that it is trying to find a little bit of balance.

I’m looking for signs of exhaustion that I can sell into, perhaps off the daily chart. Regardless, I have no interest in buying, and I do think that we will continue to see a lot of noisy behavior going forward, with a 1.26 level offering a major resistance barrier. This is backed up by the 50 Day EMA being right there as well, so it is worth paying close attention to this neighborhood. If we were to break above it, then I would have to take a serious look at a swing trade to the upside, but right now it does not look like we have the momentum building up. I think that we are going to run out by the end of the weekend, especially as people will not want to carry a lot of risk over the weekend and wait for some type of negative headline to come in and cause problems. With that being said, I think we probably see quite a bit of pressure before it’s all said and done, especially with Friday being options expiration in so many different markets, that it could cause some noise in the currency markets.

At this point, I would anticipate that a lot of bigger traders will be starting to short this market at the end of the day with smaller positions, to take advantage of the overall longer-term trade. The 1.20 level underneath has offered support, and if we can break down below there, we could go much lower, perhaps opening up the possibility of a move down to the 1.18 level. I think it’s only a matter of time before we get down there. The interest rates in America will continue to put pressure in favor of the US dollar.

[ad_2]