[ad_1]

Looking heavy at $22,236.

Previous BTC/USD Signal

My previous signal on 20th July was not triggered as the reversals took place beyond the key levels which I had identified that day as probable support and resistance.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered before 5pm Tokyo time Tuesday.

Long Trade Ideas

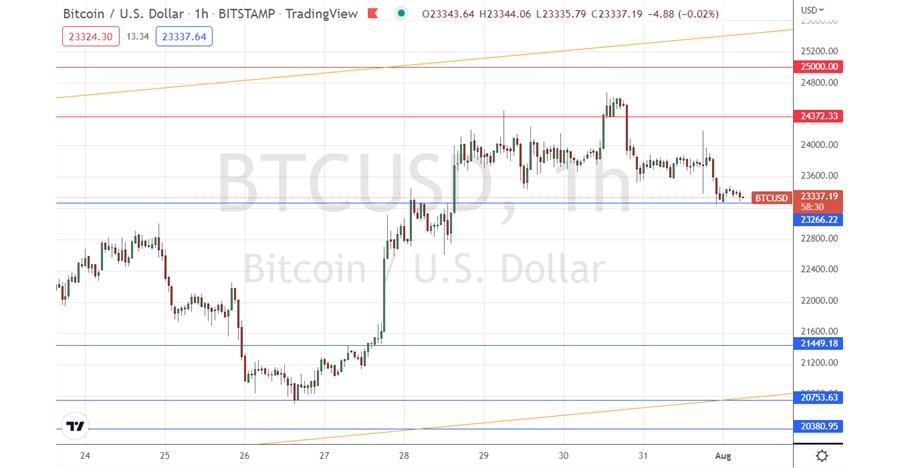

- Go long after a bullish price action reversal on the H1 timeframe following the next touch of $23,266 or $21,449.

- Place the stop loss $100 below the local swing low.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Go short after a bearish price action reversal on the H1 timeframe following the next touch of $24,372 or $25,000.

- Place the stop loss $100 above the local swing high.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote in my previous analysis on 20th July that the price of BTC/USD was likely to continue rising due to the strong short-term bullish momentum and lack of any foreseeable risk events. This was an OK call insofar as the price rose over the London session, but eventually ended the day lower.

The Bitcoin rally continued over the past week, reaching a new 6-week high last Thursday, but not by much. The price quickly reversed and has been trading downwards ever since. However, the price still remains within a symmetrical bullish price channel but has fallen from an area near the top of the channel.

The price now seems to have reached a pivotal point: the support level at $23,266. This support has not yet broken down, but the price does look heavy here and we could well see a breakdown today. If the breakdown does happen, it could be quite strong as there are no support levels below until $21,449 so the price has plenty of room to fall. The lower trend line of the bullish price channel is well below that horizontal level and trend line analysis can be very useful for an asset as responsive to technical analysis as Bitcoin typically is.

I see the best approaches to Bitcoin today as looking for a long trade from a bullish bounce at $23,266, or if that level breaks down, a short trade below it, ideally from a failed retest of the level from below, with the short entry coming after the price bounces bearishly off $23,266. Shorter-term traders might not wait for the retest and instead just try to sell on short-term rallies as they turn bearish.

Concerning the US Dollar, there will be a release of ISM Manufacturing PMI data at 3pm London time.

Ready to trade our daily Forex signals? Here’s a list of some of the best crypto brokers to check out.

[ad_2]