[ad_1]

Risk management is advised, with your position sizing being crucial and everything at this point in time.

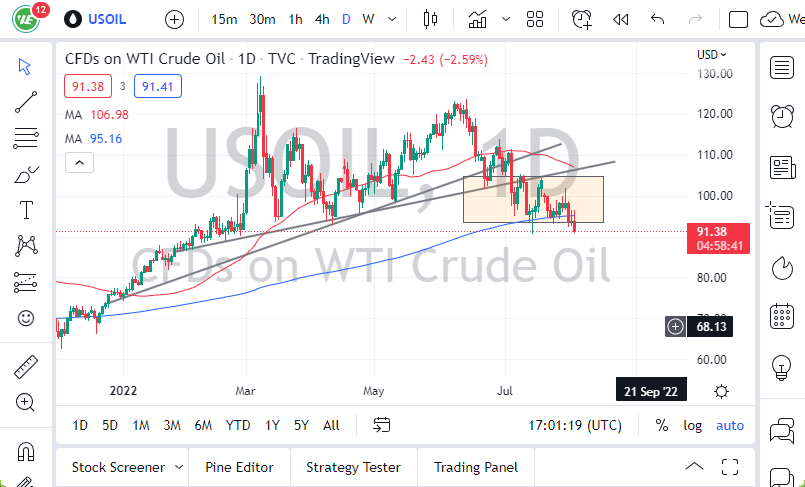

- The West Texas Intermediate Crude Oil market initially tried to rally Wednesday but then plunged quite rapidly.

- As demand for crude oil continues to drop, this is going to be a running narrative in this market.

- The $90 level underneath will be crucial to pay attention to because it could open up the next wave of selling.

Breaking Below $90

Anything below the $90 level probably allows the market to drop down to the $80 level given enough time. Yes, we are below the 200-day EMA now as well and are threatening to break through a major consolidation area. While we could bounce from here, the reality is that the market has been somewhat relentless in its selling pressure, and it’s probably worth noting that even though OPEC has decided not to increase production, prices continue to fall anyway. This should tell you exactly what traders think about the economic outlook going forward.

That being said, if we were to recapture the $100 level, we would have to pay close attention to this market, because it might be ready to go much higher. At that point, we would probably retake $110 via the 50-day EMA. I’m not necessarily calling for that to happen, I’m just suggesting that it could be the outcome. Market participants continue to see plenty of reasons for negativity, and I think that’s probably the one main takeaway from here is that the market simply cannot pick up its feet. Because of this, I think that you will continue to face short-term rallies to show signs of exhaustion.

The Federal Reserve is tightening its monetary policy and is going to continue to do so. This is negative for risk appetite, which in turn is negative for all kinds of things, oil included. The main thinking right now is that an economic slowdown is going to drive down demand, and there is very little in the way to change that opinion. With this, I think that we will break down sooner rather than later, especially with the markets being as volatile as they have been, not just here, but everywhere else. Risk management is advised, with your position sizing being crucial and everything at this point in time. I would not get cute here and try to pick the bottom, as it looks like we haven’t made it yet.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.

[ad_2]