[ad_1]

I am still looking at this through a prism of fading short-term rallies.

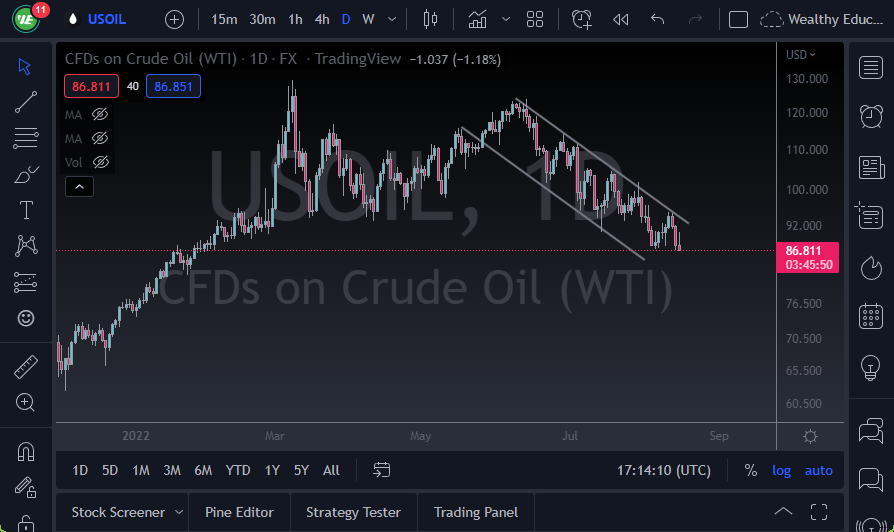

- The West Texas Intermediate Crude Oil market initially tried to rally on Tuesday but has also seen quite a bit of selling pressure.

- The market continues to be a scenario where we are looking at the possibility of a severe lack of demand.

- After all, if the global economy is going to continue to slow down, then it’s likely that we have further to go.

Will Iran Increase Supply?

Furthermore, the Europeans continue to give good signs that the Iranians may be able to come to the table and start selling more crude into the markets, and that of course will increase supply in a market that’s already starting to see a serious concern about being oversupplied. Whether or not that will last for the long term is a completely different question, but right now it’s a very negative type of market.

The $100 level above is a significant resistance barrier, and if we were to break above that level that it’s possible that we could go higher. If we do break above the $100 level, then it could open up a move all the way to the $120 level. That being said, it’s worth noting that the market is continuing to pay close attention to the down-trending channel, so that’s worth paying close attention to as well. That being said, we have plenty of reasons to be bearish, at least in the short term.

The $85 level would be a potential support level, but if we were to break down below there, then we could go down to the $80 level. The $80 level is a large, round, psychologically significant figure, and an area that will probably attract a lot of attention. That being said, I think the only thing that you can count on is that there’s going to be a lot of volatility, especially if there is a sudden shift in the situation coming out of Iran and the European Union. If they suddenly blow up the idea of a potential deal, that will take roughly 1 million barrels of potential supply out of the market each day. That obviously would be bullish for the price, but ultimately, I think it’s very unlikely that the global slowdown will continue to saturate the headline, so I am still looking at this through a prism of fading short-term rallies.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.

[ad_2]