[ad_1]

At the end of last week’s trading, the price of the Japanese yen fell against the rest of the other major currencies. The USD/JPY currency pair achieved gains after a rebound towards the resistance level 123.03 and closed trading stable around the level of 122.55. Recent profit-taking occurred after the pair tested its highest levels in six years and pushed it towards the support level 121.28. The US dollar rebounded sharply along with interest rate differentials and with stock markets broadly advancing amid a clear improvement in investors’ risk appetite, prompting some to reconsider the resistance level of 125 for the USD/JPY pair.

The yen is a popular asset during turbulent times.

On Friday, the Japanese yen did not benefit from further declines in crude oil prices, which fell by double digits during the week, but instead fell against all major currencies and a few US dollars. In general, the price of the US dollar rose broadly after the US non-farm payroll report for March showed that the United States continues to recover the jobs it lost due to the Corona virus, with the unemployment rate falling within reach from its lowest level before the pandemic.

And while the USD/JPY was already rallying ahead, Friday’s data appears to be spurring an extension of the move, bringing the USD/JPY back to 1.23 and completely reversing the drop seen on Wednesday after the MoF expressed concern about the recent declines. for the Japanese yen. Commenting on the performance says Greg Anderson, FX Analyst at BMO Capital Markets. “With flows on the bottom and the Japanese authorities on top, we think the 120 to 125 range is likely to continue for most of the second quarter. However, we give a higher probability of breaking the range at the top.”

The US economy added about 413,000 jobs in March while the country’s unemployment rate fell to 3.6%, leaving just 10 basis points from the historic low of 3.5% seen in the final months of 2019. So, economists and analysts say, this is likely to The Fed is encouraging rate hikes faster than in any modern monetary cycle as it seeks to contain inflation that has risen to its highest levels in several decades.

Mazen Issa, Senior FX Analyst at TD Securities says “Unless the BOJ abandons yield curve control (instead of just gradually raising the target) and adopts a hawkish stance/starts to tighten policy, which it hasn’t done with any inclination Seriously for nearly two decades, the tidal wave will not offset “higher US yields and the fed funds rate”. “The bottom line is that the interest rate differential channel will remain more favorable for the US dollar than the Japanese yen,” the analyst added.

And while the interest rate differential between the US and Japan is likely to be just as important as any other factor cited as a contributor to the six percent rise in the USD/JPY rate in the last quarter, if not more, There are also other factors that are likely to contribute to the yen’s decline as well.

Therefore, we expect the price of oil to decline gradually in the second half. Lower oil prices will significantly alter the international dynamics of the Japanese yen, and lower oil prices can lower inflation and expectations outside Japan, so expectations for aggressive rate hikes may be tempered somewhat. In this scenario, the strength of the dollar-yen will weaken with the increase in oil prices.

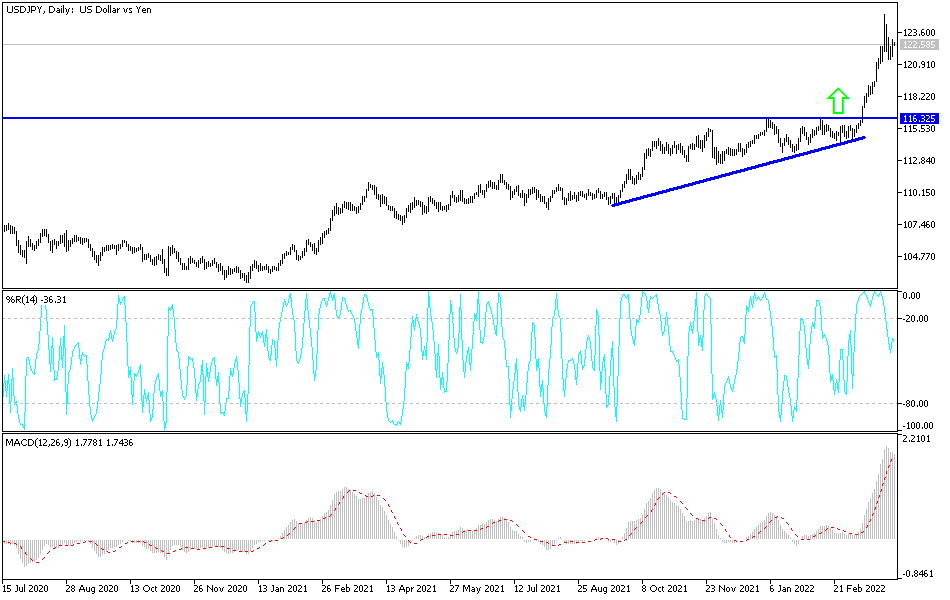

On the daily chart below, the price of the USD/JPY currency pair is trying to return to the path of the ascending channel, which is still the most prominent performance of the currency pair so far. A breakout of the resistance 123.00 help the bulls make a further push to the upside. Despite the optimistic outlook, I still prefer selling USD/JPY from every bullish level. On the same time period, a breach below the 120.00 support will be of great importance for the bears to move towards the crucial 118.55 support, turning the pair’s current outlook to the downside.

[ad_2]